Demand for labelstocks has increased for the first time in a year, according to European self-adhesive label association Finat, having previously suffered four consecutive quarters of decline since Q4 2022.

Finat’s Rada report/research showed that labelstock demand in Europe increased by 2.1% in Q4 2023 compared to the same quarter in 2022. The report predicts that demand will continue to grow in 2024.

The period of decline from Q4 2022 was attributed to a mix of post-Covid excess demand, raw materials shortages, stockpiling, supply chain disruptions, cost increases and economic decline, all of which hit hard on the label industry throughout 2023, the report said.

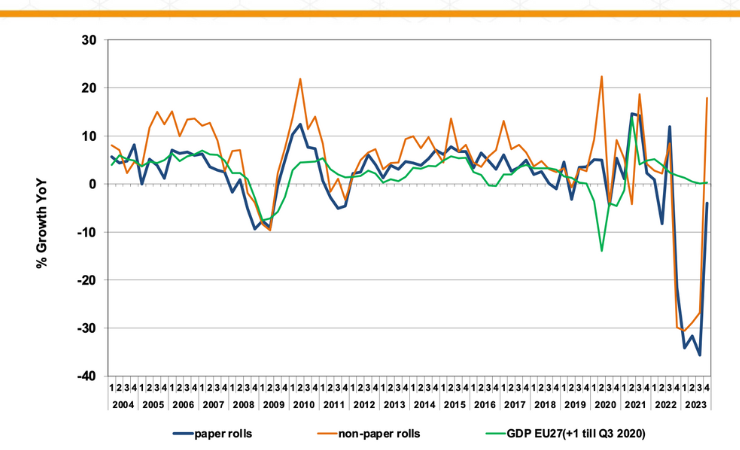

Compared to 2022, European consumption of self-adhesive label materials last year decreased by no less than 25.8%, the ‘sharpest’ decline in a single year recorded since Finat started the collection of statistics in 2003.

The pattern of decline in labelstock consumption was similar across major end-use segments including food, beverages, and health and beauty care, all sectors that showed promising signs of recovery in the final quarter of 2023.

Europe’s decline in labelstock demand is described as ‘more prominent’ and ‘prolonged’ than territories outside Europe and compared to other sectors in the labelling and packaging domain. One explanation is the stockpiling effect that was triggered by the prolonged paper industry strike in Q1 2022, resulting in a battle for raw materials (notably paper-based release liners and label facestock materials) and lead times of three to five months.

When raw materials availability returned to normal in the third quarter of 2022, the economic tide had turned, and label printers and label users had filled their warehouses for quarters to come. The downturn was compounded by the effect of increasing raw materials costs that, according to the Finat Radar, impacted the procurement of labels more than other packaging types.

According to the report, during the brand owner survey and interviews conducted, respondents highlighted the significant challenges they have encountered due to evolving consumer demands. These challenges included a shift in consumer preference from branded products to private labels, alterations in seasonal demand patterns, and an oversupply of materials for certain stock-keeping units (SKUs) triggered by a drop in demand.

A European sentiment indicator, which forms part of the Finat Radar, identifies a decline in consumer confidence across the Eurozone, reflecting widespread concerns about inflation, energy costs, and the potential for economic downturn. However, a slightly brighter outlook from label suppliers and brand owners suggests optimism about the capacity for recovery and growth in the coming quarters.