Finat reports an increase in sophisticated, high-end labels

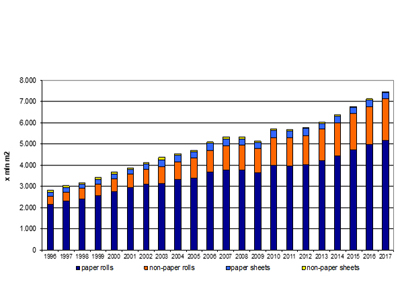

According to Finat’s latest findings demand for PP-based materials has grown 78%, direct thermal papers are up 51% and white coated papers have seen a 24% increase since 2010.

The figures show that while paper based materials continue to dominate label materials demand, there has been a shift from basic primary and VIP labels towards more sophisticated, high-end applications.

Jules Lejeune, FINAT managing director, commented, ‘The continued growth in demand for packaged consumer goods, especially in emerging economies, has increased the need for white, coated materials as end-users are looking to differentiate their branded products on the shelf. Labels containing variable product data in sectors like retail, logistics, process automation and inventory management demand an ever growing volume of direct thermal papers. But above all, the need for high quality (transparent) product decoration in high speed, high volume sectors like food, health and beauty care and premium beverages is driving the surge in the consumption of PP-based labels.’

The trend is encouraging self-adhesive label producers to offer adjacent high-end packaging solutions like pouches, sleeves and other flexible packaging items.

The continued evolution of Eastern European markets also remains a key growth driver – while established markets Germany, UK, Italy, France and Spain still account for 58% of the total European market size, Poland and Turkey are catching up and are expected to challenge the top five in the next few years.

There are, however, significant European disparities when comparing demand in terms of consumption per capita indicating a huge potential for future structural growth.

There is a clear statistical correlation between roll labelstock demand and the general economic climate according to Finat’s statistical agency Panteia.

Mr Lejeune stated, ‘Given the present uncertainties associated with Brexit, escalating trade wars between the EU and the US, continued trade sanctions against Russia and, finally, re-emerging concerns about the euro following the installation of the new Italian government, it should come as no surprise that the gap between annualised growth rates in the label industry and GDP has been shrinking in recent quarters after five years well above GPP growth rates.’

The spring 2018 edition of Finat Radar, created with partner LPC, confirmed the buoyant state of the label industry. Average annual sales growth over the past five years was 7.1%, although this slowed in 2017 compared to previous years. The highest growth rates were recorded in non-prime markets like automotive, consumer durables and industrial chemicals while the largest labelling sectors of food and beverages continue to be among the top five growth markets.