The increased quality demand in flexo printing is one of the major drivers in ink product development. Others include the demand from retailers to reduce the cost of packaging overall, higher shelf appeal and the continued price rise in raw materials. Neel Madsen asked suppliers how they are meeting these demands.

The conflict between raw material prices that are skyrocketing and converter and brand owners’ focus on cutting cost while still putting products on the shelf that stand out in the crowded supermarket space is putting a squeeze on inks and coatings manufacturers. Press speeds are also increasing while time to market is being reduced and all consumables have to be able to perform under these conditions.

Expanding the options

Fujifilm has brought three new products to market recently which have been developed to reflect the need of the printing industry, and the label market specifically, to reduce costs while maximising press speed or output volume. The products give printers added opportunities to explore new printing options.

UVivid Flexo JDSWH Shrink Sleeve is a UV curable white ink specifically designed to allow the printing of a high slip, opaque product. In turn, this allows for a faster, smoother and blockage free application. In the same range, Supernova White gives printers the ability reproduce a rotary screen white with a flexo process while the High Opacity UVivid Flexo JD inks were developed to provide the capability to reproduce the opacity levels typically seen with rotary screen inks on clear filmic substrates without the need for a backing white.

The company said that Supernova White and High Opacity Colours especially have allowed a number of customers to take on new business as well as providing the ability to move from screen to flexo.

Flint Grouprecently launched ‘Next Generation’, a nitrocellulose-based product range based on concentrates and a range of technical components to meet all requirements of high end flexo printing. The range is multipurpose, mono-pigmented, offers maximised colour strength and cleaner process shades, minimised particle size with enhanced pigment stabilisation, improved cleanability and rheology for better flow. The main applications are surface print and lamination in combination with polyolefin films (PE and PP) and chemically treated polyester covered by FlexiPrint MV and FlexiStar MV.

With VarioLam AB, the company launched its latest flexo PU (polyurethane) technology, which is dedicated to multipurpose lamination work, including the production of pouches and laminates for sterilisation application. This will allow a complete substitution of the formerly used PVB (polyvinyl butyral) technology as well as the transfer of some gravure work into flexo.

The need to provide standout shelf appeal but keeping costs low is another incentive to innovate. Paragon Inks has entered into a strategic partnership with suppliers of stamping foils, Foilco Ltd. Using their combined R&D skills and market understanding, the two companies have launched a new added value process called Holoemboss. This is aimed at brand owners, multiples and private companies using product decoration by way of UV flexo or letterpress printing.

This combination process uses a transparent holographic film from Foilco and a bespoke coating technology range from Paragon Inks, the 600 series. Promising to add value at little cost, Holoemboss is used in the cold foil unit of a UV flexo or letterpress machine and applies a surface printed holographic effect to the substrate.

Sun Chemical’s SunBarOxygen barrier coatings address the industry’s challenge to reduce waste costs and minimise packaging while still maintaining all the critical functioning properties of the packaging structure. These coatings are designed to enable lightweighting of packaging by removing the metal foil and one layer of adhesive from packaging, as well as offering improved laminate flexibility. A smooth, homogenous, pinhole-free layer, SunBar can be overprinted with inks and laminated to a variety of secondary films. It is recyclable, biodegradable and press-ready, allowing for lighter-weight packaging, a reduced carbon footprint and easy application with few changes to current equipment.

The company also recently introduced SunUno Solimax for both surface and reverse print applications on a number of flexible packaging substrates. The range is suitable for both flexographic and rotogravure print processes offering a reduced inks inventory.

Low migration

The risk of migration from the printing on food packaging into the contents has seen the introduction of special low migration inks which are now offered by a number of suppliers.

Zeller+Gmelin reports that it has been enjoying successful sales growth with its Uvaflex Y77 flexo ink for paper and foil applications and Y71 UV low migration flexo ink. In addition to being available as Pantone bases, the inks are also available as mono-pigmented concentrates, which offer customers the ability to mix a wider variety of colours and print with lower anilox roller volumes.

From its UK base in West Thurrock, Essex, the company is additionally able to offer high quality UV inks for sheet-fed and continuous offset printing on papers and plastics with its Uvalux U40 and U70 products, inks for plastic container decoration and an extensive portfolio of UV coatings and special effect products. All inks are available in standard or proven low migration versions for food packaging applications, and in both Pantone and mono-pigmented concentrate base schemes.

November will see the official opening of a newly built, dedicated unit for the production of low migration UV inks at the Zeller+Gmelin headquarters in Eislingen, Germany, and the company is in the process of seeking official accreditation status which will enable its in-house analytical facility to independently certify customers’ food packaging according to EU legislation.

Sales director Marcus Ruckstaedter, said, ‘Our ongoing focus on uncompromised product quality and customer service is paying dividends for us and we have ambitious plans to expand our sales activities over the coming months.’

The main driver for ColorGen continues to be food safety, said its managing director, Mark Bowman. The small specialised manufacturer is accredited with ISO 9001 PAS43 (Quality Assurance), ISO 14001 (Environmental Assurance) and OHSAS 18001. Mr Bowman explained that the company is implementing a three tiered system approach in order to be able to offer customers products that fit their requirements. New products will be introduced alongside its established inks and coatings during the latter part of 2012 and early 2013.

Level one consists of inks and coatings based on established technologies for use generally outside the food and drinks industry. Level two is inks and coatings formulated to reduce their potential to migrate, whose suitability can be proven through relevant testing of both packaging and wet products. These types of systems can be suitable for many types of food packaging but can still be cost effective for the average printer. Level three is inks and coatings formulated using only those materials where specific toxicological data and/or reliable test results demonstrate absolute minimal risk, even in the face of poor processing techniques, with these materials clearly identified by an impartial authoritative body which holds the interests of the public first, not by a packaging specifier.

The latest products from Pulse Roll Label Products include new SLM Flexwrap and SG UV flexo formulated inks for shrink films and labels. The SLM series offer a range of EuPIA compliant formulations for shrink film and indirect food packaging applications. The SG series offers similar characteristics but is not intended for food packaging.

The new ranges are complemented by EL088 a UV flexo, semi-gloss release varnish for peel and read applications, and the RLM series of metallic gold and silver inks and foil effect brights for flexo, screen or letterpress printing.

Commenting on the issue of low migration, James Buchanan, sales director packaging at Stehlin Hostag, said, ‘Achieving a low level of migration with UV printing depends greatly on how thoroughly the UV ink and lacquer film is cured. The less completed a curing process is, the more constituents from binders, thinners and photoinitiators remain potential migrants. The quality of the low migration UV flexo inks therefore needs further to be improved.

‘Formulating inks without potentially migrating low molecular weight raw materials whilst keeping high colours strength, good flow characteristics and low organoleptic properties are the challenges for the ink formulators.’

The company also offers the Hydro X range of water-based flexo inks which consist of high density mono-pigmented concentrates coupled with a range of specially designed extenders. The extenders allow drying at high speed application, increased coverage, improved plate release and optimum mileage whilst the small percentages of concentrates used deliver high colour strength at little cost.

The range has been enhanced in order to complement changes in anilox technology, plate technology and printing substrates. The company also manufacture MGA (low migration) water-based flexo inks for sensitive packaging applications.

‘Water-based flexo inks used in the narrow web, bags, sacks, envelopes and pre and post-print corrugated sectors must deliver cost effective formulations and optimum press performances including higher running speeds, higher definition, higher density and improved coverage,’ said Mr Buchanan.

Metalllics and custom

A relative newcomer to the market is Color-Logic, a North American company that backs up its metallic ink offering with what it calls a complete colour system. Its Process Metallic Color System permits package designers and printers to print any of 250 metallic colours with just conventional CMYK process inks plus silver. The key to the process lies in the Color-Logic software, a plugin to most widely used design programs. This is used by graphic designers and print pre-press personnel to create the five colour PDF files necessary to execute designs.

The system provides a means of producing metallic effects without using metallic inks. The software can also produce a CMYK plus white ink set for printing on metallic substrates. With the white ink effect layer, the metallic substrate provides the desired sheen and various hues are created with the CMYK inks. Where metallic effects are not desired, the effect layer automatically masks out the substrate without manual edits.

The process can be used for offset lithography, flexography, digital printing and screen printing, which means that metallics can be implemented not only in the whole range of packaging, but across an entire marketing campaign with point-of-purchase materials, banners, and collateral literature.

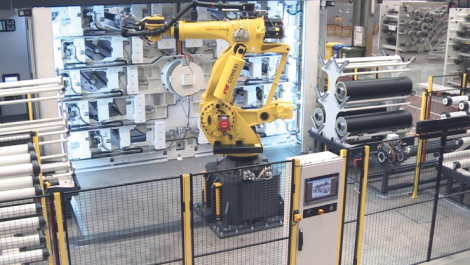

Doneck Euroflex has recently expanded its British production facilities at Milton Keynes to include two fully automatic dispensing systems, making it capable of custom ink manufacture for the UK. The company serves customers in the flexible packaging, paper packaging, corrugated, envelope and heavy duty sack markets with water-based and solvent-based flexo and gravure inks.

The company has expanded its customer base in recent years in Britain and continues to grow. ‘Our strong focus on customer requirements and building real working partnerships as well as our genuine flexibility are the guiding principles for serving the UK market and the development of our UK site reinforces this,’ said Mark Jones, UK business director.

Challenges

The list of challenges faced by inks manufacturers is long and demanding. The tough economic climate is pushing converters and brand owners to save costs on packaging print but the ink quality must still be able to conform to high standards. For sensitive food application, the inks also need to comply with increasing amounts of legislation.

‘In any print business, the ink is only one component of the finished product. Developments in machine speed, curing technology, thinner gauge materials and other technological demands on the finished product are key challenges for any progressive ink manufacturer,’ said James Whitehead, business development manager at Fujifilm.

Sustainable demands on packaging is another driver as is the high raw materials prices. In the last two years, the ink industry has seen a steady stream of cost increases and supply constraints from nearly every category of raw material used in packaging inks.

Michael Impastato, vice president strategic marketing, global packaging and narrow web, Flint Group, said, ‘In many cases, we experienced multiple increases and in some cases materials saw increases monthly or quarterly. This resulted in the absorption of cost by the ink manufacturer since cost pass through could not be implemented on a timely basis. Raw material cost increases from a timing and magnitude basis were historical during this period. Therefore, some of these cost increases are still working their way through the supply chain creating tension in customer relationships and uncertainty in forecasting.’

‘With the challenging economy, rising costs of production materials and increasing sustainability compliance requirements, converters are looking for ways to create production efficiencies or cut operating costs,’ said Sun Chemical’s marketing director EME, Angus Blundell. ‘One method many converters are using to improve pressroom efficiency is upgrading their presses to increase high speed capabilities.’

He continued to explain that Sun Chemical sees the greatest opportunity for growth for flexo in the packaging market, especially as the industry trend in the market continues to move towards functional and sensory packaging. Source reduction, a smaller number of packaging layers, along with decreased package size are ways consumer packaged goods companies are looking for support in their sustainability efforts.

Additionally, biodegradable and more recyclable flexible packaging materials are currently favoured by both major retailers and brand owners as these key areas relate to sustainability.

Mr Ruckstaedter commented, ‘As with others in our industry, we have suffered raw material and other cost increases which we unfortunately have to pass on to our customers, even though some of them do seem to be in denial about the reality of the cost situation. However, we have mitigated some of these cost increases through production efficiency measures and driving our marginal costs down via increased sales into both domestic and export markets.’

But will the price rises continue? Mr Impastato said, ‘Although the rate of cost increase has slowed we are still seeing rising costs. In order to help our customers plan for 2013 we are advising them to budget for a 4% to 6% price increase in the first quarter of 2013.’