A typical late stage customisation product

The retail packaging supply chain has developed with rapid turnaround and low cost as the main drivers. Flexo competes well for regular repeating orders, but it does not allow much flexibility. Brands and retailers want to boost sales, with pressure mounting for versioning and more promotional messaging to engage consumers, however, this may not suit flexo in specialist converters. By Sean Smyth.

Iwell remember a meeting I was involved in with ‘a leading supermarket chain’ when I was working for a large packaging supplier in the UK a few years ago. We accompanied a major brand and were shown a diagram looking like the Olympic rings. The top three rings represented the packaging manufacture, product manufacture and filling, and the final product on sale in store. The bottom two were packaging stored in our warehouse waiting to be called off and he stock of completed packaging at the food producer waiting to be filled. The buyer explained that the packs cost some £12 per 1,000 packs (1.2p each) and he simply said, ‘We have calculated that the two stockholdings contributed 80p of the cost’ and then he invited a formal response the following week on how we might eliminate this cost. Then he closed the meeting before we could discuss improving quality through full process colour capability.

The supply chain

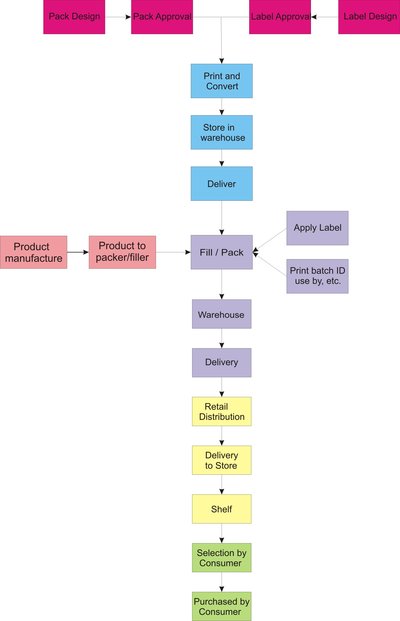

Current packaging supply chains for high volume goods follow the same basic route that has been refined over time. Figure 1 shows five separate players being involved for mainstream retail packaging: an agency, the item manufacturer, packaging (and label) converter, packer/filler, and retailer (this may differ for individual cases).

Fig 1. Typical supply chain for retail packaging

A design agency may develop the design, functional and graphics for the pack from a brief (or following established brand guidelines). There will be a proofing and prototyping cycle, with supermarket approval needed. Then artwork will be delivered to the printer who will produce the job and deliver or store for future call-off. The packs may be filled at the manufacturer, or at a specialist packer/filler which will also apply any label and print the necessary batch details and best before date information. Goods may then be stored at the filler or delivered into the retail distribution system where it is then delivered into individual stores. They are then placed onto the shelf and (hopefully) selected and bought by the final customer.

There are many handover points through the chain, each is a cost and potential source of waste, or worse an out of stock situation resulting in missed sales opportunities. As the variety of packs has increased, with more sizes/flavours/colours etc, so the number of labels and packaging has grown and there are many opportunities for spoilage and redundant stocks. If a product is withdrawn there may be waste packaging at the converter or at the filler. If there are any changes in ingredients or a design change to the product, the packaging becomes obsolete and has to be scrapped. It is difficult to see how the flexo converter can improve the chain other than by reducing the cost which may not be good for maintaining profitability.

It is like this because it allows quick response and most importantly low cost and it works well providing the designs do not change. High speed wide flexo printing with standing plates mounted onto cylinders allow quick set ups with low makeready for a wide variety of pouches, bags, films and cartons. One large manufacturer of gable-end drinks cartons printed with flexo and gravure explained that while there still are many long run jobs, there are also lots of small runs mixed in. The measure of ‘jobs per reel’ becoming a viable alternative to ‘reels per job’.

Pressure is mounting

The purchasing people have been attacking cost. There is some re-engineering, using lower cost materials and simplifying production and there is competition to keep prices keen. Using more efficient suppliers can help but for most printed packaging there is not a great deal of fat left to cut. Converters will try to batch jobs, avoiding colour changes and substrate variation, often taking risks with stockholding to reduce costs.

At many of the larger packaging and label users, there is pressure between purchasing and marketing functions. Often it is difficult for the converter to talk with the marketers. Digital label suppliers are very happy with some of the micro brands where one person is making all the decisions (although there may be quite a helping hand needed). In larger companies, this can be an issue where the marketing function may be looking at innovative features to boost a product. They are usually looking for two key things, to sell more product, and to sell the product at a higher price. The role of purchasing often seems to fight against this, with the price the key property, with speed of response just behind. Flexibility is necessary with order quantities likely to vary considerably as seasons change, or if a product takes off.

Pressure is building to increase the flexibility of the chain. The relatively high costs of flexo pre-press (compared with litho and very low costs in digital) become irrelevant when a design is reprinted many times. Keeping a design constant means the consumer is not surprised and recognises a product, but it may restrict additional sales opportunities. Litho press suppliers Goss and KBA are identifying flexible packaging as a market for their technology with the Sunday VPak and Varius 80 web machines providing variable cut off alternatives to flexo. These benefit from very low pre-press costs and set up with high levels of automation and may allow high quality short runs economically.

Some marketers want more. Coca-Cola is one of the leaders and the ‘Share a Coke with . . .’ campaign proved to be so successful that it has been repeated from Australia across Europe this year. This printed 150 of the most popular names in many European countries onto Coke bottles, mixing the names across the runs using digital printing. They did not release the costs of the campaign, but it is obvious that overprinting gravure and flexo with HP Indigo personalisation does not come cheap. The aim is to increase involvement and sell more product. This versioning is not geographical within countries, so the retail distribution chain is not affected. They handle pallets of bottles just as they would the standard product.

Local logistics

The difficult issue is to get regional and local variations on many products to make them more attractive for a local market. A large supermarket may handle 30,000 individual stock keeping units (SKUs), some estimates put this at 50,000. With a chain of 600 stores, providing local versions represents a logistical nightmare for the distribution. One change may be to print in-store (as some price labels and shelf edge material is now), but until printing becomes much easier this is unlikely.

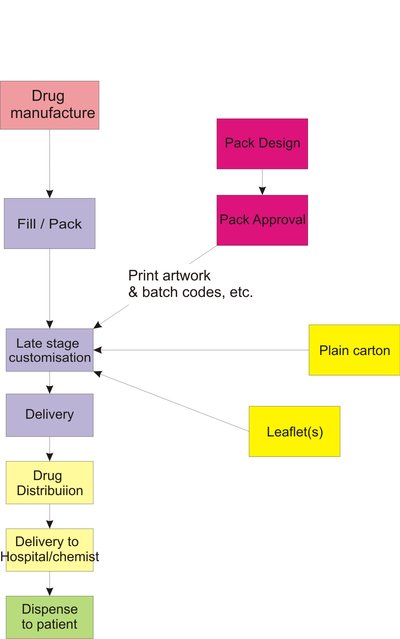

Fig 2. Late-stage customisation supply chain for pharma packaging

Late-stage customisation is growing, particularly in pharmaceutical packaging on blister seals, labels and cartons. Atlantic Zeiser, Hapa and Heidelberg have all reported many successful installations where packs are printed after they are filled with the particular drug in question. This involves digitally printing, usually with inkjet, onto white or partially printed cartons, labels and foils. Systems allow full colour printing at good quality and the batch details and unique coding can be incorporated, in whichever language is required. This will cut out a separate packaging or label converter, and many pharmaceutical companies act as the packer/filler. They will use many fewer pack types, simplifying their logistics and allowing any updates to the information required to comply with local regulations in a region to be printed on-demand. This eases the supply chain for some pharmaceuticals and it is being widely adopted. In time, other industry sectors will look at the potential provided by new print technology, and the supply chains will improve. It is the brands and retailers who will demand the changes, and adding value becomes ever more important.