The AWA Label Release Liner industry seminar gathered in Brussels the day before Labelexpo opened

Every year during the busy autumn season of packaging industry shows and conferences, the release liner industry takes a day out to analyse its present, and its future, in pressuresensitive labelling. It was Europe’s turn this year to host the AWA Label Release Liner industry seminar, and a healthy number of participants, from every level of the value chain, convened in Brussels in late September.

Considerable dichotomy surrounds label release liner today. Its quality and performance are not in question, as leading brand owners confirm through their continuing preference for pressure-sensitive labelling for premium products. Equally, release liner (whether paper- or film-based) is fully recyclable and sustainable.

It is, however, at the end of its working life that the label release liner finds itself lacking an appropriate and unified modus operandi for transitioning it back into the processing chain for recycling and re-use.

Optimistic outlook

Opening the seminar, AWA Alexander Watson Associates’ president and CEO, Corey Reardon, confirmed that business in the roll label sector ‘continues to be optimistic’. Globally, growth in the use of release liner across all its market segments averaged out at 4% in 2012. The Asia Pacific region showed the greatest growth at 7.1%, but this is a significant slowing down on prior years. South America and new arrivals in the growth markets, Africa and the Middle East, both evidenced growth rates of 4.5%, while North America at 2.1% growth and Europe at 1.9% both just managed to match approximate GDP growth.

UPM-Kymmene is the world’s largest manufacturer of release base papers. Mikko Rissanen, product manager, paper business group, examined the global trends impacting release liner, their implications for the business and its technology, and product and sustainability issues and innovations.

The scarcity of some raw materials, particularly platinum, and the resultant high costs, he showed, continue to create problems across the value chain, as do the issues of sustainability, global competition, and market instability and volatility. Material innovation, renewability and recyclability, a cost-efficient production process and supply chain, and technical service and support from suppliers that are viable for the long term are the key challenges for the future, he said.

Label maker’s viewpoint

‘A label maker’s perspective’ on label release liner was provided by Alan Hazlewood, group quality and technical support manager for major multinational label and application technology providers, Skanem AS, whose focus is on primary product labels, and 99% of whose production is in pressure-sensitive labels.

Mr Hazlewood said, ‘Our liner mix is roughly 53% honey glassine, 41% white glassine, and 6% film (of which 70% is PET 30).’

Skanem’s requirements for release liners are technically clear: standardisation between suppliers and across grades; consistency in thickness (for die-cutting), in strength (as an unsupported web), and in curl (for label layflatness); and controlled siliconisation in terms of coat weight and process control (avoiding voids and inclusions) for optimal release.

Analysing the major challenges facing the label end users, he underlined that ‘my market is very, very conservative – it reacts in a very slow way’, and three areas at user level create challenges to change – brand management, purchasing management, and operations management.

Still, the major change drivers in Skanem’s experience are related to net price improvement and environmental/sustainability impact. For on-press running and high-speed, reliable label application, the company finds that glassine liner is the answer, with film liners providing solutions in specific market niches, but with some performance ‘watch outs’. Recycling must, Mr Hazlewood said, ‘be disciplined and stand up economically.’

The fact that matrix waste is located at the end-user site and at the end of an extended supply chain makes achieving this mission difficult.

The option of linerless label materials is one with which Skanem already has experience, but, while there are many indicative savings to be made by taking this route, it has its limitations because of label shape restrictions. Mr Hazlewood’s market prognosis is that price parity across the release base options is opening up competition, with market-specific performance requirements and sustainability issues playing an increased role. ‘Long term,’ he showed, ‘all the options will be on the table’, with glassine losing some market share to alternatives, PET establishing itself as the global film liner, and linerless growing in appropriate markets and continuing to innovate.

Alan Hazlewood, group quality and technical support manager for Skanem AS

Alan Hazlewood, group quality and technical support manager for Skanem AS

Brand owner’s viewpoint

Dennis Bakx, global category buyer packaging materials for Heineken global procurement, focused from a brand owner’s viewpoint on sustainability and recyclability in beverage labelling. With over 250 brands and 165 breweries in 70 countries, Heineken is the world’s third-largest beer brewer in an increasingly consolidated market environment.

The company is also committed to ‘brewing a better’ future through sustainability, with four particular priority areas in focus: water, CO2 , sourcing and responsible consumption. Mr Bakx showed how this commitment tangibly delivered results in 2012 on a variety of important internal and external fronts.

What, then, are his requirements for release liner? With an emphasis on film liner, Heineken is looking for reductions in liner thickness or, indeed, linerless labelstock; bio-based and biodegradable plastics; the delivery of overall environmentally responsible performance; recycling and re-use; and eventually a global supply chain wide approach.

Mr Bakx is very well informed on current activities and options. He showed that his company understands the high value of PET liner, and how the company is moving from ‘collection in recycled industrial waste’ to ‘collection in the plastic waste stream’. But, he underlined, this is not easy.

A clear European supply-chain-wide approach is currently missing, and needed – as is a one-stop-shop partner for Heineken in this arena – in Europe and, potentially, globally. This view has considerable relevance for the label release liner industry seminar participants because, after all, a minimum 95% of all Heineken beer bottles are pressure-sensitive labelled.

A silk purse

The question as to how you can actually make a silk purse out of a sow’s ear is one that is familiar to Calvin Frost, CEO of Channeled Resources Group and long-time campaigner for responsible use of valuable materials, including used label release liner. Mr Frost’s presentation pulled no punches, and addressed participants directly. ‘Why don’t you force the paper industry to use a percentage of recycled release liner fiber in new release liner?’ he asked.

There were, he said, 360,000-400,000 tonnes of ‘spent’ paper release liner available for repulping and 20,000 tonnes of PET/PP spent liner for reprocessing in Europe in 2012. ‘And how much did we repulp and/or re-melt in Europe in 2012? Under 30,000 tonnes. That’s about 7% of available spent liner.’

He illustrated the various ways in which the physical logistics of waste packaging, transportation, pre-processing, shipment and delivery can be, and are already, achieved efficiently. His call to action was for an industry forum to focus on change in the industry in this critical area of activity, to really ‘define the problem and provide solutions’, Mr Frost said, adding that the key is to have them ’embraced by the top people in the industry’.

FINAT recycling

FINAT has established a release liner recycling project that embraces ‘best practice’ across EU environmental policy, the EU Packaging and Packaging Waste Directive and the label industry’s corporate drivers, such as retailer and brand owner ‘green’ initiatives.

Mark Macaré, public affairs and recycling project manager, updated delegates on the current status. He indicated that there are, indeed, commercial solutions available today but that ‘critical mass is needed’. He identified the bottlenecks in the label industry’s recycling chain particularly the problem that spent liner is generated downstream, where collection creates a logistical challenge and there is lack of awareness and urgency among label end users.

Linerless

In one sense, the day’s agenda could be summarised as ‘linerless or less liner?’ and this was the title of the paper presented by Mike Cooper, business development director of linerless labelling experts Catchpoint Ltd. Illustrating pressure-sensitive labelling’s penetration into key end-use segments in Europe and North America, he highlighted the fact that food and beverage represent the lowest penetration, yet the largest markets. Linerless labels could help, Mr Cooper showed, delivering a summary of activity in the label printing, die-cutting and application arena.While acceptance of the improved performance level of linerless labels has so far been slow, there is certainly evidence of real innovation here.

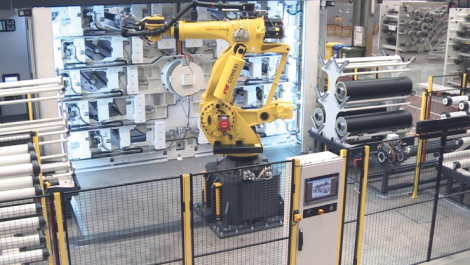

Concentrating on one of those advances, Roelof Klein, commercial manager of the Maan Group, specialists in glueing and surface treatment technologies, showed how his company’s Inlinerless system can print, silicone coat, and adhesive coat linerless label material, ready for application, in one flexible production run and, using groundbreaking cutting and marking technology, create an increased variety of label shapes and optimise reliability on the labelling line.

In summary

Dennis Bakx of Heineken succinctly summed up the day’s proceedings. He said, ‘I shared my requirements and at the same time learnt more about the industry. In our production cycle, after application of the label, the release liner becomes a waste material and I am looking for possibilities to do something smarter with it.

‘I am happy to see the industry is putting more and more focus on sustainability and look forward to the (joint) extra steps that we can take, and that also need to be taken. In the end, I expect that a supply-chain-wide approach will indeed prove to be the most effective outcome.’