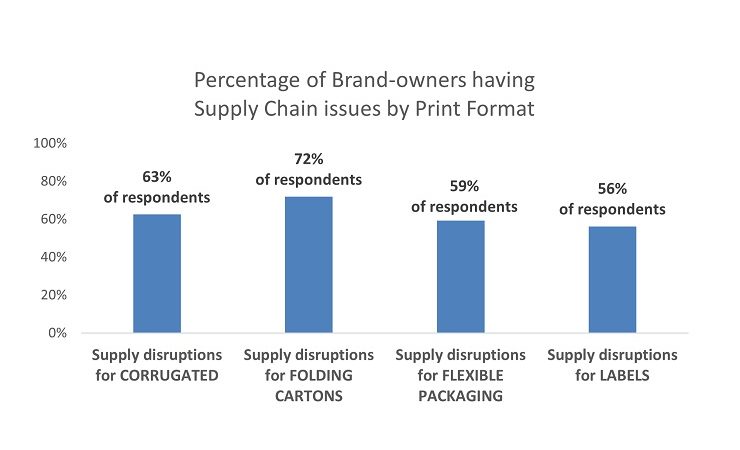

FINAT’s industry analysis, RADAR, has picked up that supply chain distortions and sustainable label and packaging solutions are the biggest worries for label providers and brand owners.

The report was conducted in the autumn of 2021, a tie which saw severe raw materials, components and labour shortages, excessive rises in delivery times and demand supply gaps resulting in exponential increases of raw materials and energy prices.

The report confirms that these supply chain concerns are of equal importance among the actors at the ‘bottom end’ of the supply chain: labels and packaging specifiers, engineers, sourcing and procurement, R&D as well as print production leaders active in the food & beverage, personal care, pharmaceuticals, chemicals, consumer durables, automotive and retail sectors.

LPC’s Jennifer Dochstader, who headed the research, commented, ‘During every conversation we had, two topics were front and centre: Supply chain and sustainability. There is tremendous concern at the bottom of the value chain regarding the stability, and availability, of raw materials and the ability for label vendors to meet delivery demands and lead time requirements. The current upheaval in raw material supplies has made all of us keenly aware of just how intricate and interconnected the global supply chain truly is. Each and every company we spoke with also indicated that they want to work more closely with their label vendors to co-create innovative ways of making the printed packaging industry a more resilient, and more sustainable one.’

Apart from the role of labels and narrow-web packaging in essential sectors, supply chain concerns are compounded by the fact that more than three quarters of the respondents indicated that they are planning to increase label procurement in 2022 in response to continued economic recovery. On average, label procurement is expected to increase by a robust 5.4% this year. For digital labels, the expectation is even a percentage point higher, at 6.4% as label users seek to source small run sizes and fast turnaround times, particularly during this time of the pandemic. Increased interest in recycling programmes Illustrated with quotes from senior end-user officials, the report also zooms in on the dynamics between buyers and converters in respect of lead times, delivery standards, production facilities, alternative labels and packaging solutions, environmental sustainability requirements as well as release liner recycling protocols.

According to the report, a growing number of respondents are involved in a liner recycling programme. Compared to a year ago, the percentage of respondents indicating that they are involved in a liner recycling programme more than doubled to 41%, whilst by contrast the percentage of respondents indicating they are not involved in such a programme shrunk from 30% to 10%. 63% responded that they are willing to make used liner available for collection in hubs, provided these are within a 200km range of the factory.

FINAT president Philippe Voet (Etivoet, Belgium) added, ‘What happened in 2020 was only small beer compared to the global supply chain disruptions that we have seen in the second half of 2021. Currently there are shortages of almost everything: energy, chemicals, pulp, (waste)paper, plastic, inks, transport, laminates, chips, components, people. A recent survey in Germany confirms the battle for raw materials resulting in price increases between 5-10% in most segments of the supply chain. Time will tell whether these tensions are a temporary adjustment problem and that there will be ‘soft landing’ in the spring of 2022, or that we are dealing with persistent tensions with a longer lasting impact that could hurt the recovery. It is clear from these numbers that there is no single section of the value chain that is not hit or to blame by these external factors.

Irrespective of these short to medium term tendencies, we should not lose sight of the other mega challenge facing us in the longer run: climate change and the need to make a transition to more circular economy models. The present supply chain tensions could accelerate the move from linear to circular consumption, turning spent products into new raw materials. In that sense, the report makes me positive about the prospect for our industry’s collective responsibility and the role that FINAT can play.’